Monitoring for distributed organizations

Use wire-speed network data to better differentiate legitimate from malicious traffic.MantisNet's solution is an agentless, cloud native, client authentication and attributions service that organizations can leverage to identify and terminate fraudulent activities in real-time. This is done by inspecting all clients that are requesting access to, or initiating transactions within your applications and workflows.

The service leverages end-point data related to each client, as well as wire-data generated by the client's actions, in situations such as remote employee access (WFH), to determine if the client is indeed authorized, or if it has malicious intent.

How real-time validation and authentication works

For any transaction involving client and host interactions MantisNet's solution provides authentication of the client via TLS handshakes and JA3 fingerprints to name a couple (more below) as well as the applications being used by the client. MantisNet's solution generates and processes over 300 unique characteristics of the client application requesting/processing each transaction in order to:

- validate transaction legitimacy by including 300+ feature characteristics to determine if the transaction is sourced from legitimate humans and authorized users, or if it is sourced from bots or other sophisticated invalid traffic (SIVT) types

- continuously monitors web-based systems for fraudulent and malicious activity

- Inspects and compares machine-data AND wire-data, creating a unique fingerprint for all end-points/clients

- Inspects all transactions/events from clients that are accessing web-based applications

- publishes enriched metadata into existing workflows for processing or

- invoke traffic management capabilities to filter, redirect, shunt or terminate

- filter traffic to completion, terminate or redirect for fraud analysis and/or collection

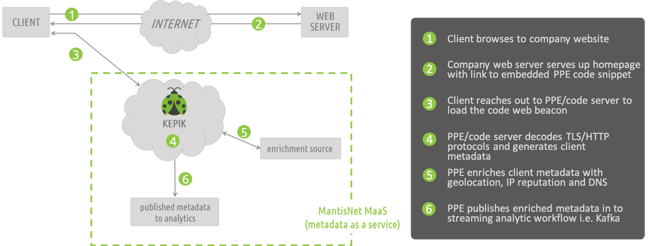

The process is powered by MantisNet's Programmable Packet Engine (PPE) and unique solution code to monitor the real-time interactions between clients and hosts of transactions. The process can scale to millions of events, while continuing to interrogate the 300+ characteristics of each individual client, and improve decisioning through the inclusion of additional data enrichment sources (e.g. DNS, IP reputation, geolocation, to name a few) to provide real-time detection and authentication of the user or entity transaction.

MantisNet reduces cyber risk and fraud to your operations by:

- Provide enhanced visibility and authentication of client endpoints to enable analytics to discern Sophisticated Invalid Traffic (SIVT) from valid transactions.

- Monitor and secure transactions with deeper authentication and validation for enterprise access, customer service, ecommerce, payment processing, and point of sale applications.

- Differentiate malicious ad traffic from legitimate impressions and clicks by providing new forms of high-resolution visibility into client endpoints and client/server interactions - saving money on payments to malicious affiliates and ad resellers

Any organization that relies on secure and authenticated actions, transactions can realize the benefits of MantisNet real-time stream-based fraud intelligence. This includes enterprise access, retail, ecommerce, banking, financial services, energy, infrastructure, education, government, healthcare and digital advertising.

Want to learn more? Contact Us with any questions.